Avoiding Probate in Atlanta

Learn How to Avoid Probate in Georgia

In Georgia, when a person dies, their estate passes through probate. This is a formal court process that ensures the decedent’s debts are paid and their assets are distributed according to their will or, if they died without a will, in accordance with state intestacy laws. In addition to being time-consuming and expensive, probate can bring a considerable amount of stress to families who are already struggling with the loss of a loved one. There are ways to avoid probate, however, with proper estate planning and the guidance of a skilled Atlanta probate avoidance attorney.

There are several ways to avoid probate in Georgia:

- Establish a living trust

- Name specific beneficiaries for accounts and securities

- Establish joint ownership of property

At Meyring Law Firm, we have extensive experience with probate and estate planning and can use this knowledge to help our clients avoid probate. Call (678) 257-3332 to learn more!

Establish a Living Trust

With a living trust, you can pass property and assets to your named beneficiaries without going through probate. Unlike property left to heirs in a last will and testament, which would be subject to the probate court process, property in a living trust can be transferred directly to one or more beneficiaries of your choosing after you pass on. You can also decide who will act as trustee and oversee the administration of assets in your trust and the distribution of your property. To avoid probate, you must transfer ownership of your property to the living trust during your lifetime.

Virtually any asset can be placed in a living trust, such as:

- Bank accounts (checking, savings, money market, safe deposit boxes, and more)

- Interest in a limited liability company (LLC)

- Non-retirement investment accounts

- Cryptocurrency

- Real estate

- Insurance policies

- Stocks, bonds, and mutual funds

- Personal property

Name Beneficiaries for Accounts & Securities

To avoid probate in Georgia, you can establish “transfer-on-death” or “payable-on-death” provisions for various accounts and securities. This is essentially naming a beneficiary who would receive the balance of any specific accounts when you pass away, without having to go through probate. When you add a “payable-on-death” designation to a bank account, for example, you would still control the money in the account and would be able to spend it as you wish. Only upon your death would the named beneficiary have a right and claim to the balance of the account.

Establish Joint Ownership of Property

In Georgia, you can establish what is known as “joint tenancy” to transfer ownership of property directly to a family member or loved one after your death. Real estate, vehicles, bank accounts, and other property can be owned jointly in this way, meaning they would not be subject to probate. With joint tenancy in Georgia, each party must own an equal share of the property.

Want to Avoid Probate? Call Our Atlanta Firm!

In addition to saving time and money, avoiding probate can ensure more privacy after your passing. Meyring Law Firm is here to bring you peace of mind in knowing that you have planned for the future, protected your estate, and provided for your loved ones as you see fit. To find out more about our avoiding probate in Georgia, estate planning, and the ways our Atlanta probate avoidance attorney can help, give us a call or contact us online.

Contact Meyring Law Firm today for your confidential consultation.

Superior Client Experiences

-

"I contracted Robert for service and was extremely pleased with the entire experience."Eleanor W.

-

"I enjoyed the small firm atmosphere, courteousness, and competent staff members. I can honestly say that there was no pressure and Mr. Meyring took the time to answer all of my questions."Former Client

-

"I am grateful to Mr. Meyring for his support"Stephanie

-

"We are comforted by knowing that should anything happen to my mother, her wishes will be followed. We are VERY grateful to Mr. Meyring and to Catie for all their efforts."Rebecca H.

-

"I was very impressed with the services that I received at the Meyring Law Firm."Steve R.

Let's Build a Strong Future, Together

-

Robert S. Meyring AttorneyRobert S. Meyring is the managing attorney of Meyring Law Firm (established 2007). Before law school, he worked as an FDA investigator, was a Peace Corps volunteer high school science teacher in Tonga, South Pacific, and was the owner/operator of a residential landscape firm.View Profile

Robert S. Meyring AttorneyRobert S. Meyring is the managing attorney of Meyring Law Firm (established 2007). Before law school, he worked as an FDA investigator, was a Peace Corps volunteer high school science teacher in Tonga, South Pacific, and was the owner/operator of a residential landscape firm.View Profile

Helping with Estate Planning & Probate

In Atlanta, Georgia

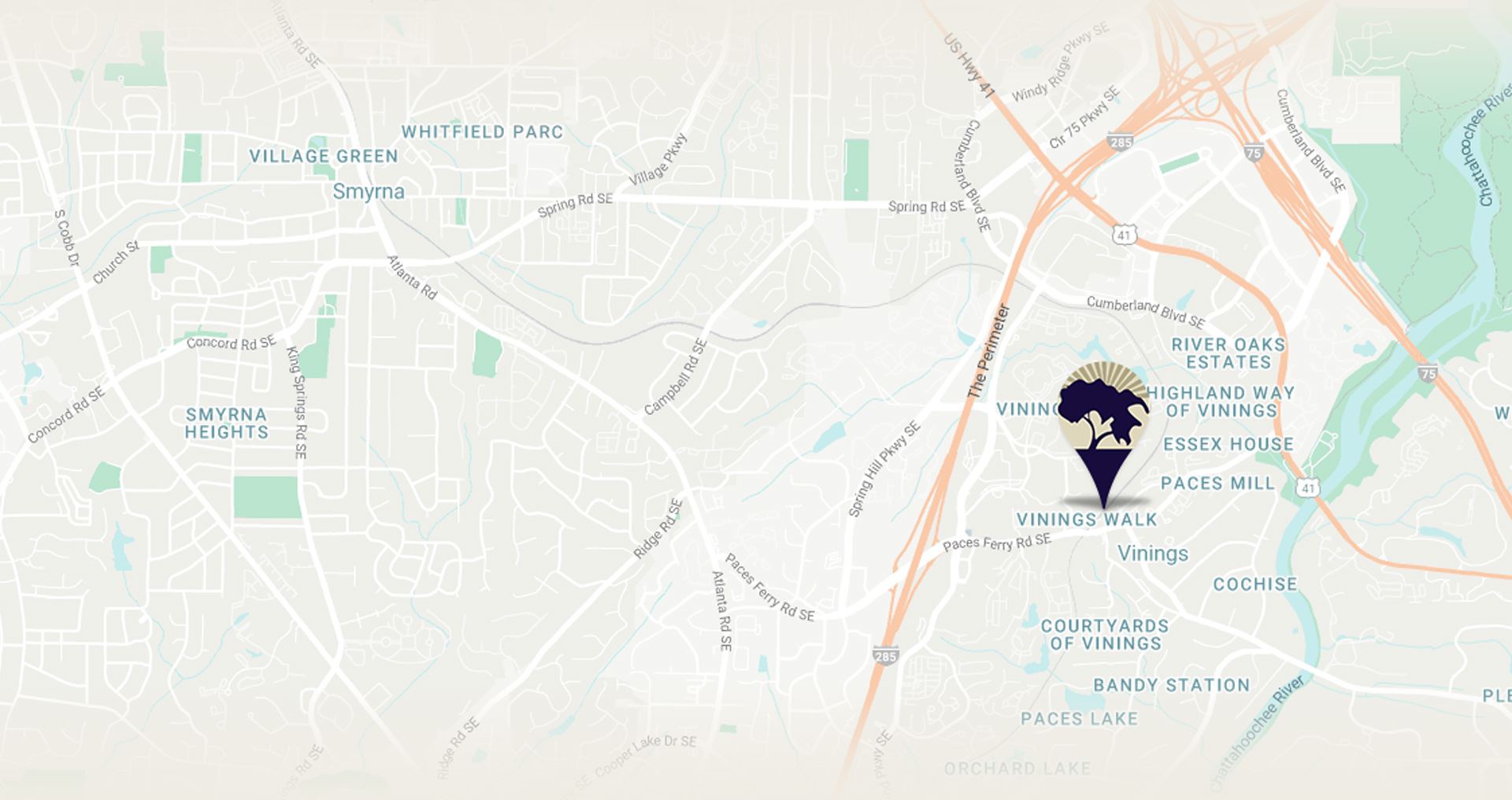

Our legal team proudly serves clients all across the greater Atlanta area!

- Atlanta

- Marietta

- Decatur

- Smyrna

- Sandy Springs

- Alpharetta

- Roswell

- Tucker

- Lawrenceville

- Kennesaw

- 30301,

- 30308,

- 30008,

- 30060,

- 30030,

- 30080,

- 30068,

- 30004,

- 30009,

- 30021,

- 30043,

- 30144

Frequently Asked Questions

Here to Help Every Step of the Way-

An individual can write his own will in Georgia but must follow certain statutory rules laid out in order to ensure the will is deemed valid by a probate court.

-

People hire a probate attorney because the benefits of having an attorney outweigh the costs of time and effort. Mainly people hire a probate attorney to save time and energy, reduce their worries, and navigate the probate process with a professional. So no, you do not need a lawyer to probate a will, if it is worth the time and effort to do it yourself.

-

Executor is the person named in the last will and testament that's appointed by the probate court to administer the estate of the decedent according to the will.

-

In Georgia, there is a legal mandate for the holder of a will to submit it to the court for probate per O.C.G.A. § 53-5-5. If a will is not filed with the court, any heir or beneficiary can petition the court to direct the will holder to file the will with the proper court. Wills are meant to be public documents once the grantor has passed away. Sometimes if a will is not filed with the court, beneficiaries and heirs cannot take legal possession of assets specified in the Last Will and Testament.